This post contains affiliate links, which means I receive a small commission, at no cost to you 🌻, should you make a purchase through a link.

When I first considered buying a home as a single mom, I quickly realized I did not know where to start and sadly didn’t know anyone familiar with the process. This is the starting point for most first-time homebuyers. Questions like, Who do I speak to? How much should I save? What is the process? are usually left unanswered.

My first action was an online search: “How much house can I afford?”

And Voila! Magically appeared a mortgage calculator; I entered in my information and instantaneously, my estimate appeared on the screen. I proceeded to my internet home search on Zillow of course… but is purchasing a home really that simple?

Actually, it’s not; reaching your goals of homeownership takes time and preparation. Buying a home as a single mom can be complicated for some because you may not have the support to make such a big move, but it doesn’t have to be a daunting process either. Your decision to buy your first home as a single mom can create stability and a nurturing environment for your family and very well- the home of your dreams.

Information is available if you know where to look; the truth is most of us don’t. Luckily, I gathered information to share with you some of the signs to let you know when you are ready to purchase a home.

1. Steady Income

You will be required to show documentation of a stable income. This is simple if you are a W-2 employee. On the flip side, self-employment can be very unpredictable compared to a waged position; If you are self-employed, ensure you know what is required to verify your income amounts. Lenders are most happy when they have proof of a consistent income flow. Lenders require this information to ensure you are trustworthy to pay back your mortgage loan.

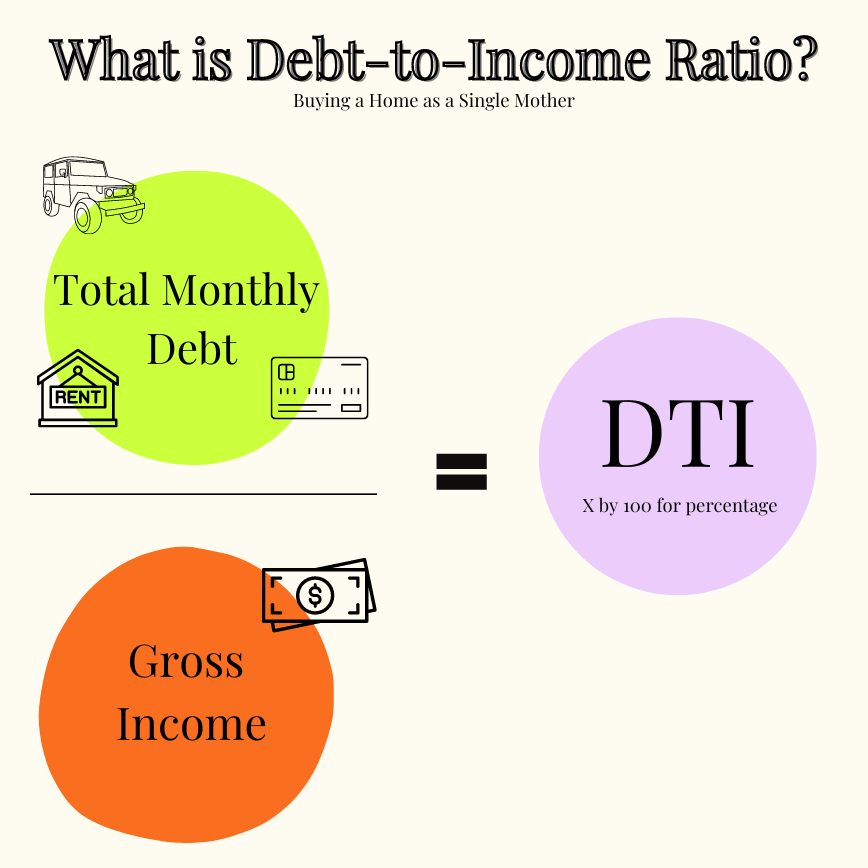

2. Low Debt To Income Ratio

Your debt-to-income (DTI) ratio calculates the percentage of income that you can pay towards your debt. Lenders are less likely to move forward with the lending process if your debt-to-income ratio is too high. “Too high” may refer to spending more than 50% of your income on debt. The actual DTI will depend on your lender, but knowing where you are ahead of time allows you to make necessary adjustments.

To calculate your DTI, you will divide the sum of all your recurring monthly debt payments by your gross monthly income (income before taxes). If your DTI falls close to or over this 50% reference point, work on lowering your payment amounts or eliminating some of this debt.

3. Credit

Your credit score determines the type of loan you may qualify for, your trustworthiness to qualify, and your loan interest rate. Although your credit score can be flawed when receiving approval for a mortgage loan, ensure your current score has been consistent and has not significantly decreased.

Only apply for new credit when considering purchasing a home if you have discussed this with a lender. Always speak to your lender before cleaning up your credit, as your credit will be crucial to this process, and you want to do everything to ensure financing is maintained.

4. All Costs Considered

It is recommended that you save at least 20% of the home cost. However, some loans require only 3.5% of the home purchase price. For example, a $200,000 home will require a down payment of $40,000 at 20% and $6,000 at 3%.

Additionally, you will need to save for closing costs, ranging from 3% to 5% of the home selling price.

Be realistic about your search. A salaried income of $4000 monthly may not be approved for a $3500 mortgage payment. Gaps in employment may prove you to be undependable on a home loan, so don’t job-hop if you are serious about purchasing a home.

5. Research

Do not wait until you find a REALTOR® to familiarize yourself with the home purchase process. Do your research and become knowledgeable about the process so you are not caught off guard by terms, timeframes, and processes. Ensure you understand terms such as conventional, FHA, fixed rate, etc. Interview real estate agents to find your best fit, and do not forget to compare mortgage lenders.

6. Top 3

Narrow your area search down to at least three areas in which you would like to live. Research these areas thoroughly, considering the schools, parks, taxes, shopping, etc. This will streamline your home search process and maximize your agent’s efforts.

7. Prepared For Costs

Not only will you need to prepare for moving expenses and cosmetic fixes, especially dopamine decor, but you will also need an emergency fund for repairs. You will no longer have the luxury of calling the landlord to fix these concerns.

8. Timeline FOr Buying a home

You don’t want buying a home to be a “figure it out as you go,” especially as a single mom. Be sure to start your home search well in advance. If you are renting, start your home search within a time frame that allows easy transition.

–Your closing date will usually be scheduled 30 days after your offer.

–Make sure your estimated closing date will fall sometime before your lease ends to allow a smooth transition into your new home. I can’t tell you how much stress will be eliminated from this.

If you have taken all the necessary initial steps listed then, Congratulations! You are ready to start the process of purchasing your first home.

It is now time to contact a mortgage lender to get pre-approved before you start your search for your dream home.

What are some concerns you have about buying your first home. If you have already purchase your first home what were some roadblocks and/or successes you have experienced?

Lets discuss them below.